LSP RENEWABLES Q1 DIRECTORS REPORT

Industry InsightsWelcome to LSP Quarterly Directors Report, an opportunity to reflect on the Q1 2024, to share our findings and give you our thoughts on the Renewable Energy market so far this year. In this quarter's instalment, we are excited to showcase the perspectives of our Global Sales Director, Seth Hunt, offering a comprehensive view of the renewable energy landscape in the first quarter of 2024. Alongside industry updates, Seth's insights shed light on the latest developments, challenges, and successes within the renewable energy sector.

Time to Globalise Supply Chain?

For several years, the strain on the industries supply chain, funding, risk inheritance and capacity to build has been growing. It has now hit a critical point resulting in awarded projects simply deemed unfinanceable and falling short of achieving FID. Due to these economic and logistical factors, developers and owners are considering viable and validated supply chain partners outside of Europe, to deliver their projects. EU based OEMs and Major EPCs continue to struggle under the demands of the sector, resulting in bottlenecks. These delays are contributing to many European and EU countries currently tracking at 80-85% realisation, and thus being at risk of falling short of their 2030 Net Zero targets. With an ever-increasing demand for capacity, and steep targets to achieve net zero, will 2024 be a year of exploring new frontiers in the supply chain?

Money, Money, Money

After a reduced market spend in Q4, Q1 proved a resurgent period for Global Investors proving the renewables sector continues to flourish. Showcased by Macquarie with an acquisition of (Enel Green Power Hellas €250m), CIPs acquired a majority stake of (Elgin Energy £250m) and Stonepeak investments trio of deals to acquire (50% stake of Dominion Energy’s CVOW project), $300m stake in Ørsted’s onshore portfolio and an 80% acquisition of TerraWind renewables APAC onshore portfolio. Then comes BlackRock’s $3bn + stock acquisition of GIP to create a World Leading Infrastructure Private Markets Investment Platform. There is no doubt the global outlook for investment and capacity within our sector is in a strong position. The increased certainty of continual long-term Investment across established renewables technologies and improving confidence in emerging avenues including BESS and Hydrogen has translated into increased opportunities for those working in the renewables sector. Experienced professionals can expect to be offered a variety of opportunities with a more diverse and dynamic employment pool than ever before.

The Price Is…... Wrong.

Having attended several conferences and seminars already this year a prominent topic has been the fallout of the disastrous and foreseen AR5 auction round, the lessons learned, and the solution. The UK is not alone with many calling for transparent two-way CFDs, In Europe the Wind Power Package presented by the EU last year will address many issues including poorly designed auctions in an attempt to kickstart the industry but it will take time to bed in. With many disgruntled parties involved in the 2023 process, Germany will follow the same ‘dynamic auction’ system utilised in last year’s 7GW round in the current 2.5GW round with bids to be submitted by June this year. Surely the answer is more consistent and collective Government liaison work so that bidders are not wasting time and resources in auctions that are not deliverable and financially sustainable.

Consolidation – A Sustainable Choice

Q1 has seen a quiet start to the year for many of our clients who have experienced significant growth in personnel and portfolio in recent years. On the run into the end of the financial year Q1 has proven to be a good time to take stock and assess the progress that has been made whilst planning their next move. It is a privilege to work with clients closely enough who share their outlook and long-term strategy meaning that LSP Renewables and talent we attract have characteristics remain highly engaged. As mentioned previously with so many projects falling short of FID and no doubt more to come assessing the risk in one’s own portfolio before embarking on new opportunities is a responsible approach, will ensure long term sustainability and assurance of project delivery. The sector requires sustained growth and with so many more auction rounds in established markets and new locations to come this year we are expecting a busier second half of 2024.

Talent Shortage

Yes, working in recruitment sales I would mention talent shortage, wouldn’t I?

However, I am not the only one talking about this, it is a prominent topic at every industry event I have attended and a serious concern to those who are building corporate teams or attempting to deliver projects. Talent/Skills shortage in renewables has been an issue since I started in the sector in 2009 and the demand for experienced workforce has increased ever since. As mere recruiters we can only do so much and I would advise all companies to consider staff retention schemes, promotion opportunities, graduate programmes, training, relocation, and repatriation. For a more comprehensive analysis of your current talent growth strategy and how LSP Renewables can offer our best-in-class service to effect change in your business please contact us to arrange a free of charge consultation.

Emerging Markets

It is incredibly satisfying to see new and emerging markets become prominent players in renewable energy. LSP has long supported our clients' first steps in new markets across the globe. To see the significant and sustained growth in countries like Lithuania over the past 2 years and with many MOmarket-leadingU’s signed in Q1 to explore offshore wind in Greece, Philippines, Vietnam, Brazil, and Canada to name a few the future of the market and opportunities continues to look promising.

Connection Issues

Despite the huge contribution and potential capacity Onshore Wind and Solar can offer to our NetZero goals Governments & Grid operators across Europe cannot align meaning Grid connectivity issues remain with little hope for resolution. With the false dawn for many onshore wind and Solar developers being assured of grid connection quicker than expected it turns out some will not be able to distribute power to consumers for up to 15 years in the future. Each country has its own issues, some require more thorough grid forecasting, others require critical infrastructure work to accommodate the significant surge in Solar and I am sad to report the UK has the longest queue to connect to the electricity grid of any country in Europe. As per a recent report these issues are currently resulting in a misalignment of 200GW capacity across 19 European countries which will affect their individual ambitions to achieve 2030 Net Zero targets.

Q1 Highlights

- Several lease auctions were launched this quarter, this includes the 3GW Round 3 Phase 2 in Taiwan, the 4.5GW Celtic Sea floating wind round in the UK, the 4GW IJmuiden Ver I-IV sites in the Netherlands, and 8GW of capacity across five sites in Germany.

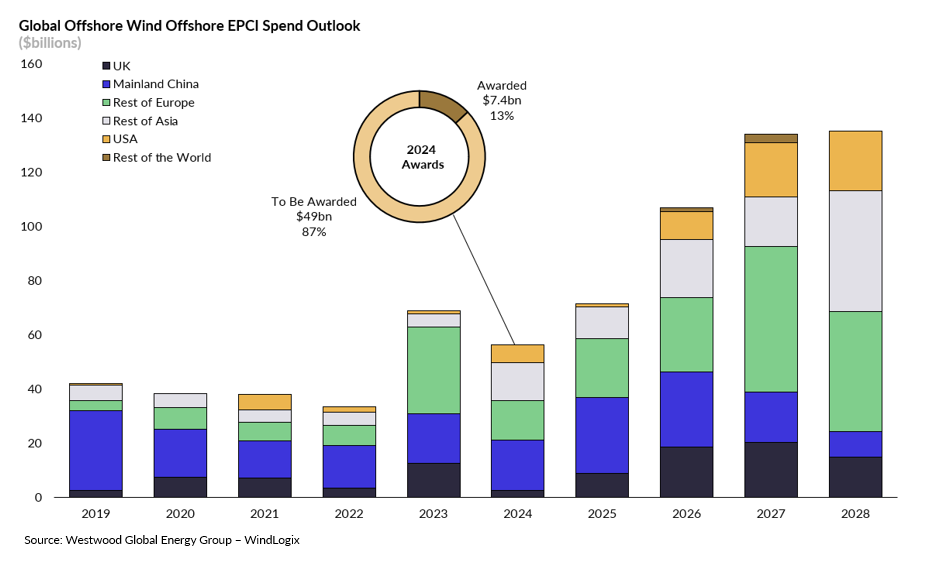

- An estimated $7.4bn of offshore EPCI value was awarded in 1Q 2024, representing 13% of full forecasted spend for the year.

- FIDs taken on 2.4GW of capacity globally and this included Orsted’s Sunrise Wind project in the US.

As the market leaders in Global Renewable Energy recruitment LSP Renewables will continue to play our part, proactively working with our clients to provide solutions and advisory services to remedy their staffing challenges. LSP Renewables prioritise customers experience and quality of service, listening and understanding their needs which have helped us to grow an unrivalled reputation. We truly value relationships, loyalty, and long-term partnerships we have fostered, and we will continue to offer our market leading services to our Renewable Energy clients.

LSP Renewables staff are extremely passionate and dedicated in our contribution towards climate change and will continue to work in support of our clients to achieve Net Zero.

To find out more about LSP Renewables market leading recruitment expertise and how we can help your organisation grow and deliver projects please contact us!

Do not hesitate to reach out to Seth, if you have any questions regarding this report.

Email: seth.hunt@lsprenewables.com

Phone: +44(0)7407 790 498

Credit to Westwood Global Energy Group – WindLogix (graph) visit their LinkedIn page here.